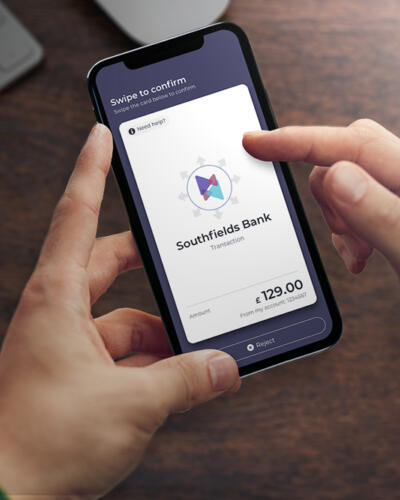

Online payments & transactions

You’ve done all the hard work – don’t lose your customers at the final hurdle. When it comes to online payments, balance transaction fraud protection and experience in the way that customers deserve and demand.

Seamless & compliant online payments

Unique positive identification

Payment scams are on the rise; no-one can escape that fact. But customer demands are also rising. It’s time you found a solution that helped you solve for both.

We'll help you simultaneously orchestrate fluid online payment experiences, navigate regulation and prevent transaction fraud with regulatory compliant three-factor authentication that works cross-channel and all in a single interaction. Now that’s friction-free peace of mind.

Reduce cart abandonment

Poor authentication experiences lead to abandoned carts. It doesn't need to be that way.

We'll help you Start More Certain by building a digital ID that passively authenticates the customer at the start of their journey, enabling you to offer a hyper-personalized experience from the moment the customer arrives – so they can breeze through with tailored online payment options.

Seamless SCA payments

Card not present transactions bring their own unique challenges. Fighting scams, adhering to regulations and delivering the experiences that customers demand: all vitally important.

We understand. Callsign delivers fast and secure payment authentication, seamlessly recognizing returning customers across your merchant base so you can offer PSD2 SCA compliant payment journeys via 3DS 2.0, and enable 'one-click' card payments.

Trusted by

We've helped:

ebook:

The impact of

scams on both

reputation and revenue

We look at how the language gap between FIs and their consumers might be impacting organizations’ revenue and customer retention rates and, the approaches and tactics your peers are using to solve this challenge.

Download it here

Whitepaper download

Reduce

costs

The true cost of your authentication solution is how much you're paying for SMS OTPs – a lot. Preventing fraud and reducing authentication costs is a lot easier than you think.

Making online payments

a breeze

Smart and compliant fraud prevention that doesn’t compromise on user experience.

Go further

Ruthless with fraud

Reduce digital impersonation fraud (including RAT, bot and manual) with increased intelligence and passive authentication.

Inherently compliant

Meet regulatory compliance with extensive control over policies, and the ability to demonstrate governance and adherence.