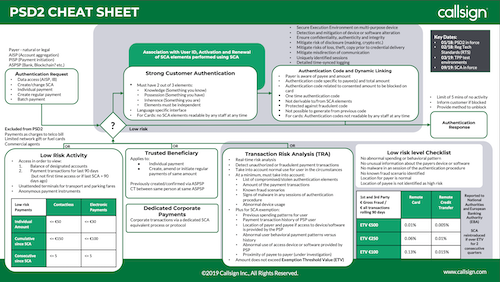

Has PSD2 and the latest EBA Opinion left you scratching your head? We've put together this handy PSD2 cheatsheet that should help you get your head around SCA and PSD2 exemptions.

If there’s one thing that’s certain it’s that regulation isn’t set in stone.

Take the latest Opinion by the European Banking Authority on the elements of strong customer authentication. It clarified that biometrics (including behavioural) are an acceptable inherence element, whilst also confirming that OTP cannot be used as a knowledge element and that card details don’t constitute as a possession element.

Just these points alone mean organizations are having to re-think their customer journeys. But when it comes to adapting policies, most decisioning and orchestration managers aren’t agile enough to make real-time changes.

Because our engineers come from banking backgrounds, we understand the need for this level of agility. Our policy manager gives businesses the flexibility to adjust and test policies quickly and in accordance with any regulatory or business need. Because policies are written in natural language, teams from across the organization can understand them as well as technical peers in IT and fraud.